Alpha Vantage data downloader

Version 0.11 (15.7 MB) by

Artem Lensky

Currently the toolbox implements functions to download company fundamentals and economic indicators.

alphavantage-matlab

Donwload cashflow reports

% replace the "demo" apikey below with your own key from https://www.alphavantage.co/support/#api-key

keyAV = "demo";

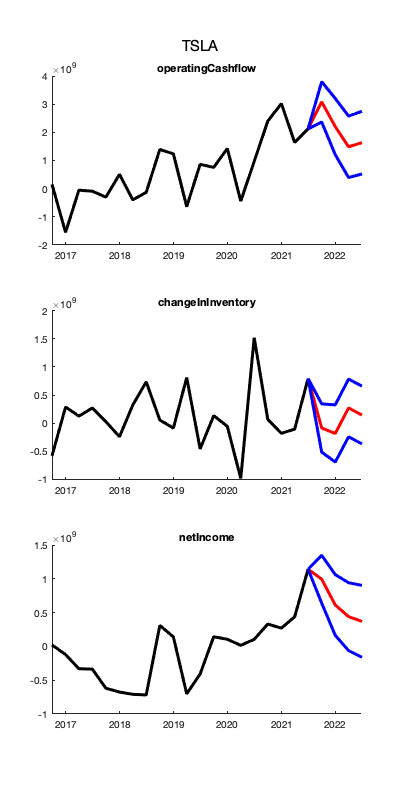

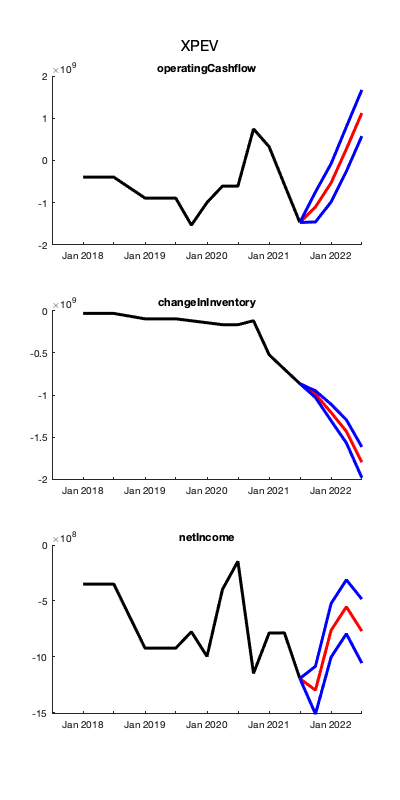

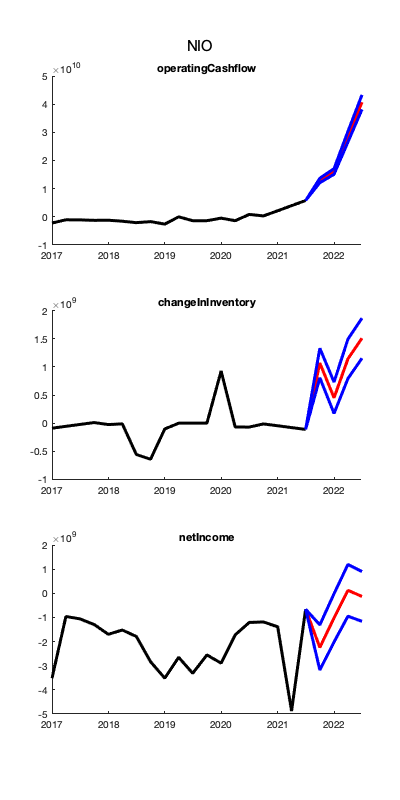

symbols = ["TSLA","XPEV", "NIO"]; % Define symbols of interest

cashflowReports = getFundamentals(symbols, "CASH_FLOW", keyAV); % Donwload reports

% convert company reports to a single table

cashflowTable = extractFields(cashflowReports, ["CASH_FLOW", "quarterlyReport"]);Predict selected cashflow indicators

% Variables to predict

indicatorsOfInterest = [ "operatingCashflow",...

"changeInInventory",...

"netIncome"];

for k = 1:length(symbols)

% Retrieve records for a specific ticker

reportPerCompany = findbyValue(cashflowTable, "Symbol", symbols{k});

% preprocess

options = struct("extrapolate", "linear",...

"removeMissingBy", "column",...

"toCategorical", "",...

"removeColumns", ["reportedCurrency", "Symbol",...

"proceedsFromIssuanceOfCommonStock"]);

reportPerCompanyProcessed = preprocess(reportPerCompany, options);

rawData = reportPerCompanyProcessed(:, indicatorsOfInterest).Variables;

Mdl = varm(length(indicatorsOfInterest), 2);

%Mdl.Trend = NaN; % Estimate trend

[normData, means, stds] = normalize(rawData); % normalise the data

EstMdl = estimate(Mdl, normData);

numOfQs = 4; % Forecast numOfQs quarters

futureDates = dateshift(reportPerCompanyProcessed.fiscalDateEnding(end)...

,'end','quarter', 1:numOfQs); % Dates to predict

futureSim = simulate(EstMdl, numOfQs,'Y0', normData,'NumPaths',2000);

futureSim = (futureSim .* stds) + means; % Denormalise

futureSimMean = mean(futureSim, 3); % Calculate means

futureSimStd = std(futureSim, 0, 3); % Calculate std deviations

% Plot the predictions

figure('color', 'white', 'position', [0, 0, 400, 800]), hold('on');

for l = 1:length(varsOfInterest)

subplot(length(varsOfInterest),1, l), hold on

plot(reportPerCompanyProcessed.fiscalDateEnding, rawData(:,l),'k', 'LineWidth', 3);

plot([reportPerCompanyProcessed.fiscalDateEnding(end) futureDates],...

[rawData(end,l); futureSimMean(:, l)],'r', 'LineWidth', 3)

plot([reportPerCompanyProcessed.fiscalDateEnding(end) futureDates],...

[rawData(end,l); futureSimMean(:, l)] + [0; futureSimStd(:, l)],'b', 'LineWidth', 3)

plot([reportPerCompanyProcessed.fiscalDateEnding(end) futureDates],...

[rawData(end,l); futureSimMean(:, l)] - [0; futureSimStd(:, l)],'b', 'LineWidth', 3);

title(varsOfInterest{l});

end

sgtitle(symbols{k});

endDownload Economic Indicators

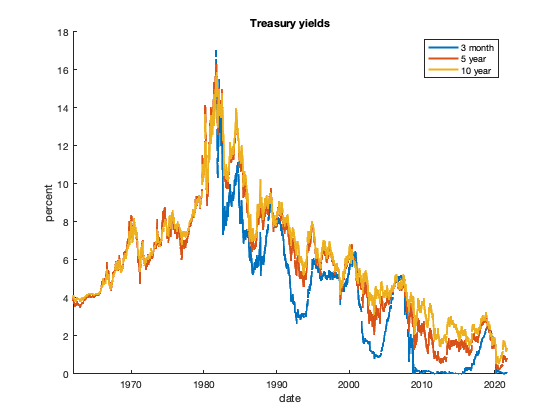

treasury_yield_3month = getEconomicIndicators("TREASURY_YIELD", keyAV, struct("interval", "daily", "maturity", "3month"));

treasury_yield_5year = getEconomicIndicators("TREASURY_YIELD", keyAV, struct("interval", "daily", "maturity", "5year"));

treasury_yield_10year = getEconomicIndicators("TREASURY_YIELD", keyAV, struct("interval", "daily", "maturity", "10year"));Plot economic indicators

figure('color', 'white'), hold on;

plot(treasury_yield_3month.data.date,treasury_yield_3month.data.value, 'LineWidth', 2);

plot(treasury_yield_5year.data.date, treasury_yield_5year.data.value, 'LineWidth', 2);

plot(treasury_yield_10year.data.date,treasury_yield_10year.data.value, 'LineWidth', 2);

xlabel('date'), ylabel('percent');

title('Treasury yields');

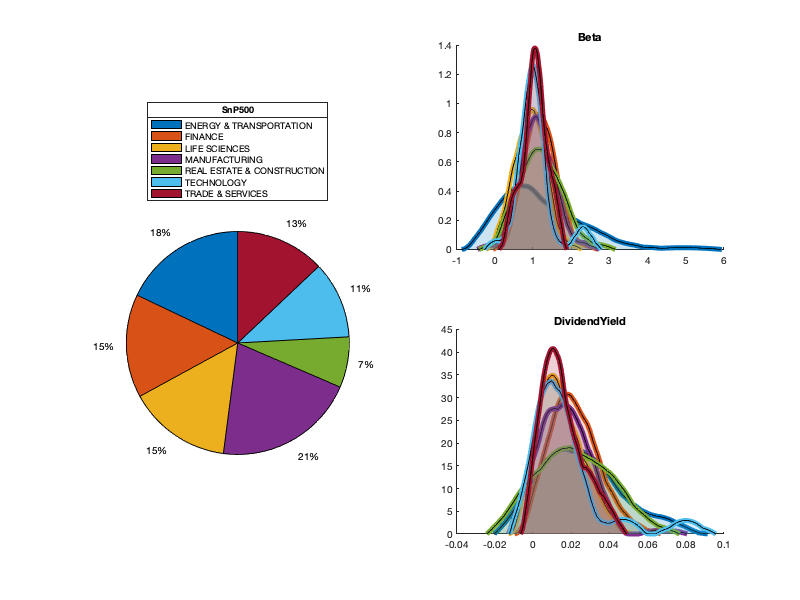

legend({'3 month', '5 year', '10 year'});Donwload SnP500

snp500list = readtable("snp500list.csv");

load reports.mat % comment this line to donwload the data

%reports = getFundamentals(snp500list.Symbol, "ALL", keyAV); % uncommentSummary of SnP500

% preprocess

overviewTable = extractFields(reports, "OVERVIEW");

sectorsLabels = unique(overviewTable.Sector);

removeColumns = ["Symbol","AssetType", "Name", "Description", "Currency",...

"Country","Industry", "Address", "FiscalYearEnd",...

"LatestQuarter", "DividendDate", "ExDividendDate",...

"LastSplitDate"];

options = struct("extrapolate", "linear",...

"removeMissingBy", "row",...

"toCategorical", ["Exchange", "Sector"],...

"removeColumns", removeColumns);

[overviewTableTirm, ind] = preprocess(overviewTable, options);

sectors = unique(overviewTableTirm.Sector);

% plot pie chart

colors = lines(length(sectorsLabels));

figure('color', 'white', 'Position', [1, 1, 800, 600]),

p = subplot(2,2,[1,3]); pie(histcounts(overviewTableTirm.Sector));p.Colormap = lines(7);

lgnd = legend(sectorsLabels, 'Location', 'northoutside'); title(lgnd, 'SnP500');

% plot distributions of selected indicators per sector

colName = {'Beta', 'DividendYield'};

for l = 1:2

subplot(2,2,2*l), hold on,

for k = 1:size(sectors,1)

overviewPerSector{k} = findbyValue(overviewTableTirm, "Sector", sectors(k));

[m, x] = ksdensity(overviewPerSector{k}.(colName{l}), 'Kernel', 'epanechnikov');

plot(x, m,'color', colors(k, :), 'linewidth', 5)

area(x, m, 'FaceColor', colors(k, :), 'FaceAlpha', 0.2);

title(colName{l});

end

endCite As

Artem Lensky (2025). Alpha Vantage data downloader (https://github.com/Lenskiy/alphavantage-matlab/releases/tag/v0.11), GitHub. Retrieved .

MATLAB Release Compatibility

Created with

R2021a

Compatible with any release

Platform Compatibility

Windows macOS LinuxTags

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Discover Live Editor

Create scripts with code, output, and formatted text in a single executable document.

| Version | Published | Release Notes | |

|---|---|---|---|

| 0.11 |

To view or report issues in this GitHub add-on, visit the GitHub Repository.

To view or report issues in this GitHub add-on, visit the GitHub Repository.