MATLAB and Simulink for

The Far-Reaching Impact of MATLAB and Simulink

Explore diverse product capabilities and find the right solution for your application or industry.

Systematically use models throughout your development process.

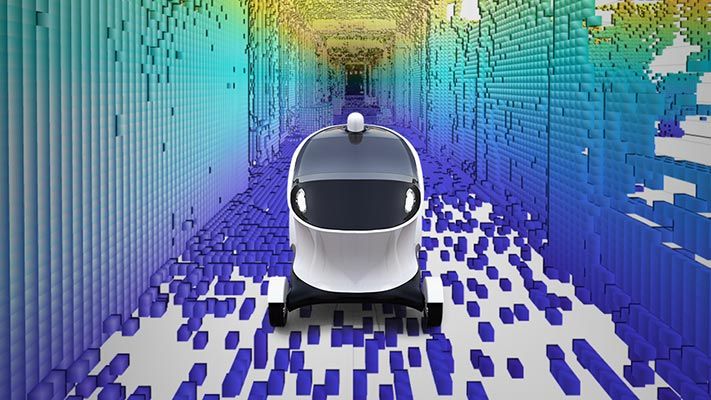

Design, simulate, and verify robotics and autonomous systems.

Develop electrical technology from components to systems.

Advance Your Skills with MATLAB and Simulink Training

Virtual, in-person, and self-paced courses accommodate various learning styles and organizational needs.

Panel Navigation

MATLAB Fundamentals

Learn core MATLAB functionality for data analysis, modeling, and programming.

Panel Navigation

Simulink Fundamentals

Discover dynamic system modeling, model hierarchy, and component reusability in this comprehensive introduction to Simulink.

Educators

Find project ideas, courseware, and tools to enhance your curriculum.

Students

Discover student competitions, training resources, and more for learning with MATLAB and Simulink.